What is rektguy and who is OSF?

Mr. Fox breaks down the hottest project on the block right now, rektguy, and who its creator is.

Hello all and welcome back to another email.

Boy does it feel good to be writing again. I know it’s been a while and I apologize for my absence. I’m not going to promise that writing will be more consistent henceforth, but I will say is that I have every desire to write here as much as possible.

Many of you have joined me here from the weekly NFT column I write for RealVision Crypto. I encourage all of you to subscribe to it as it’s where I’ve been writing for the past several months. With that being said, none of what I write here on Substack should be in any way viewed as a position of RealVision’s or related to RealVision. My work with them and what I do here is completely separate.

On a separate note, today’s email is too long for GMail users, so make sure to read it on the Substack site.

Now with the housekeeping out of the way - let’s get into today’s piece.

We’re well over a year into this NFT bull run, and, to my surprise, much of the volume we see is still dominated by profile pictures. Although it’s disappointing the space hasn’t innovated beyond profile pictures, there’s still much to be grateful - namely, that if you’re still keeping up with the market, opportunities to make money are plentiful.

This opportunity shouldn’t be understated - typically when an emerging market experiences a large influx of new market participants or users, it becomes increasingly difficult to make money in that market. The reason for this is that with more people to compete with, the less inefficiencies there typically are to take advantage of.

Where we are witnessing it become more difficult to make money in NFTs is the speed at which the inefficiencies of the market are being corrected at. When a new project launches, one may have only a few hours to buy in before it’s either out of one’s price range or has already pumped significantly.

An example of this that I missed recently is gmoney’s Admit One. Admit One is a recently launched 1,000 member exclusive web3 community led by NFT thought leader, gmoney. Clearly drawing inspiration from the PROOF collective, the first successful 1,000 member community and creators of Moonbirds, I should’ve known Admit One was a great pickup at 8 ETH, especially with the PROOF Pass trading at 75 ETH.

It didn’t take the market long to take care of this inefficiency, as Admit One traded all the way up to 15 ETH, or nearly double from when I saw it trading at 8 ETH, in just a few days.

Now, although I missed Admit One (that’s not to say it won’t go higher, but the risk-reward is not as good as when I was first considering an entry), because I keep up with the space, I still had ample time to identify that it was undervalued and understand why this was the case.

This is the excitement of NFTs; opportunities are galore for people willing to put in the time to stay acquainted with the nuanced dynamics of the market.

Some days we miss chances like Admit One, but other days, we take advantage of chances like rektguy (anybody who was following me on Twitter was able to get in when I got in too, click here to follow me)!

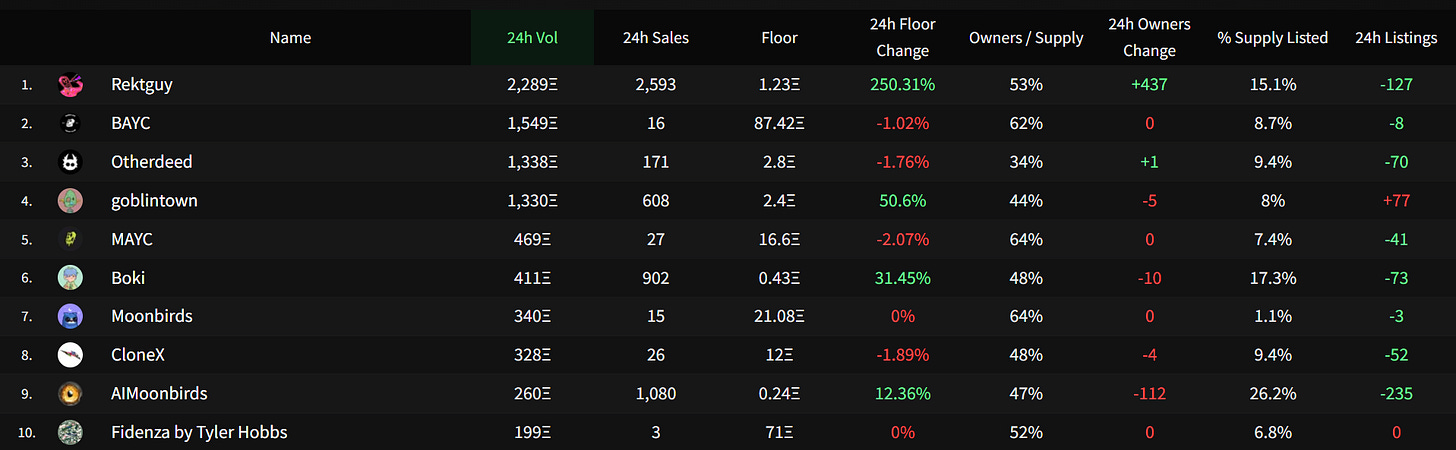

If you’ve been on Twitter over the last 48 hours, you’ll have no doubt had rektguy all over your feed. As you can see, rektguy has done more volume in the last 24 hours than any other NFT project by far. Those who purchased a rektguy during pre-reveal or in the few hours after reveal are up anywhere from three to four times on their initial investment.

So, let’s explore what rektguy is and why it’s currently on fire.

Warning: the art that is set to feature for the rest of the piece uses extreme flashing lights, if you’re epileptic or if aesthetics of this nature trigger health issues for you, you should not read on.

Here are some examples of rektguys (the first one is mine):

As you can see, rektguys are profile pictures. The art is very particular and is very much of the style of the artist who created them, known as OSF.

This glitchy, electronica, and absurdist work is one of the more popular styles in digital art, and it has been popularized by one of the greatest digital artists in the space, XCOPY.

The following are XCOPY’s three highest selling pieces ever:

All Time High in the City, last sold for $2.9 million

Right-click and Save As guy, last sold for $2.9 million

A Coin for the Ferryman, last sold for $2.4 million.

Hopefully you’re able to see the resemblances between the XCOPY pieces above and the rektguy pieces before it.

Now, let’s be clear - this isn’t to say that OSF aims to create art in the vein of XCOPY or that his work is explicitly derivative, because it isn’t. The reason I show you these pieces is to simply highlight a popular style in digital art right now.

But back to rektguy - what is it? Why is it popular?

Well, as we’ve already stated, rektguy is a profile picture project - and that’s really it. No, they have no utility and there is no project being clearly built around them. They don’t double as membership to any sort of community and they don’t promise to have benefits in The Metaverse in the future - they’re simply pieces of digital art.

The value proposition of a rektguy is that they’re not just any piece of digital art, though - a rektguy is a piece created by none other than OSF.

So, the real question when trying to evaluate rektguy as an investment is, who is OSF, and what has he produced thus far?

We don’t know too much about who OSF is, but we do know a good amount about his history in web3 and even what he was doing before he joined the space.

As is stated in the description you can see above and has been elaborated on by OSF in multiple threads, before he joined web3 he was a top trader on the trading desk at English bank, Barclays.

For those unfamiliar with traditional finance, being a top trader on any trading desk at any of the big banks is extremely difficult. Not only is it one of the most competitive jobs in the world to get hired for, it’s even more difficult to perform in. The stress of wondering whether or not you’ve beat the market, performing to the level your boss requires, and competing against the other traders is non-stop, and is often enough to drive a trader mad. Long story, short: this experience is really impressive.

As OSF has made the switch to crypto full-time, there are a few different initiatives he’s spent time developing. Let’s go through them.

Degenz

First and foremost is Degenz (and now Regenz), a profile picture project where almost nobody cares (or likes) the profile picture.

I remember minting this project late last summer - I was so on the fence about it that I didn’t even mention it in this newsletter. Thankfully I didn’t, because as soon as people saw the art, the project went straight to zero. By looking above I’m sure you can see why, it’s some of the worst art ever.

So I minted Degenz and forgot about them, until one day I started getting notifications for offers on them. This shocked me until I learned why it was that I was getting these offers - OSF and his business partner Mando were turning the project around.

They ditched the backstory of the profile picture and any attempt to build around the characters in the collection. Instead, they used each Degen NFT as an access token to the community they were building and all of the resources they were creating in the project’s Discord server. The Degenz server became a place where people could learn about NFTs, and where OSF and Mando could convey their experiences at massive trading desks in respect to the NFT market.

Today, Degenz (and their sister collection, Regenz) get access to daily market rundowns, specialized reports, community chats, and exclusive access to all future projects of OSF and Mando. For example, anybody who owned a Degen or Regen was automatically given a spot to mint a rektguy, a highly-coveted position that has netted those who minted a minimum of 1 ETH, or ($1,800), at time of writing.

Here are the OpenSea links to a Degen or Regen if you’re interested in purchasing one.

Canary Labs

More personally, OSF runs (again in collaboration with his business partner, Mando) Canary Labs, which mainly exists as an NFT fund. Before May 6, Canary Labs was known as The Canary Collection, and existed solely as an NFT fund. They’ve recently transitioned to a group that runs Degenz, offers consultantcy services, makes venture investments, and, like always, manages an NFT fund.

I find Canary Labs to be an exciting firm, especially with how nestled their team is in the heart of the NFT market. I look forward to seeing what they can do in the future.

OSF’s Art

Now with two major undertakings in the form of Degenz and Canary Labs out of the way, we’re still yet to get to what OSF has built the majority of his reputation around - his art.

As we went over in the beginning of the piece, OSF is known for glitchy, neo-modern, digital art. The best way to go over OSF’s art is 1) to show you it, and 2) explain how he has set up the utility around his art ecosystem

First of all, you should scroll through his works on your own, which you can find at osf.art.

OSF has a few different things happening simultaneously within his art creations.

First and foremost, he has created a number of fantastic 1/1 of pieces. Here are two of my favourites:

toxic +

professional degen

With every 1/1 owned, OSF drops the collector three new pieces per month. This adds a financial layer to the art collecting process, as now one has to factor the future revenue of the piece any time they go to sell it.

In a similar concept to the airdrops OSF gives his 1/1 holders, he created Red Lite District (pictured below):

Instead of creating Red Lite District (or RLD for short) as 1/1, OSF released 210 copies. Anybody who owns an RLD receives one piece per month by OSF. Although not as great as the three pieces per month guaranteed by a 1/1, twelve pieces per year from OSF isn’t much to complain about. Currently, the floor on RLD is 16.69 ETH on OpenSea. I’ll link the collection here if you’d like to check it out.

We’ve covered a lot of ground today, but finally, here is where rektguy comes into the fold.

As the latest expedition in his digital art creations, not a 1/1, not RLD, and not any of the airdrops each of these two receive, OSF created a profile picture project, which you now obviously know is rektguy.

We covered what rektguy is earlier, but to jog your memory, remember that rektguy is simply a profile picture with no utility attached - it’s a piece of digital art.

Ok, we know what rektguy is now, how did it do and what does its future look like?

rektguy surpassed the market’s expectations at its launch. OSF allowed his holders to mint a rektguy over a five day period. If somebody minted within these five days, they received an “unrevealed” rektguy - essentially just a placeholder before the real thing came in after everybody else had minted.

Well, the way projects usually go is that in the lead-up to their “reveal”, the price of the “unrevealed” placeholder NFT will go up, and then, as soon as the project “reveals” and everybody gets to see the art of the collection along with their particular NFT(s) for the first time, the price comes down. Usually this will happen because some people overinvest, and when their NFT “reveals” and they receive a really common piece in the overall collection, they worry they’ll lose money and so they try and get out while they can. Of course this simply creates a cascading effect where more and more people start selling, but alas, it is the nature of the game.

rektguy did not have this issue for one main reason - the project was free to mint, so nobody had too much incentive to sell because everybody was in the green from the start.

So, as the unrevealed floor of rektguy pushed to 0.4, as the reveal began, the floor simply continued to move higher. This was incredibly bullish signal to NFT traders and investors, and encouraged many of them to invest.

On the way up, the project was marked by major investments from three big players in the NFT space.

MoonCat sets rektguy’s first all-time high sale with a 5 ETH purchase of rektguy

The first major rektguy sale came from OSF mega-bull and NFT degenerate trader MoonCat, who picked up this 1/1 rektguy for 5 ETH very early on.

Major NFT collector, Bharat Krymo, gives it his stamp of approval

Punk 6529, the most influential and followed NFT leader, set the new all-time high sale when his 19.69 ETH bid on rektguy #2850 was accepted.

6529 added to his vault with one of the best rektguy’s in the collection, another 1/1:

As these events unfoled and momentum continued through the night, the rektguy floor got as high as 1.4 ETH at its peak.

So, what’s next for rektguy? Where do we see it going?

rektguy is a really high effort art drop that many people are loving. It really couldn’t have come at a better time, as cryptocurrencies continue to bleed and traders and investors continue to get rekt. rektguy is a great play on this scenario, and I’m sure that’s part of the reason it’s receiving so much attention right now.

With that being said, the path forward for rektguy is currently unclear. OSF currently states that rektguy will have no utility. Of course, as we’ve explored in today’s piece, this would be unlike OSF. Although he’s stated that it isn’t coming, I wouldn’t be surprised if rektguys had some benefit to holding down the line.

Other than that, I worry that OSF is currently diluting his pieces at a faster rate than the market can keep up with. As the price of a rektguy increases, the knowledgeable OSF holder may consider selling it to pick up a different piece of his, which we’ve already been seeing in the short lifetime of rektguys. Not that he needs to, but how will OSF manage to drive the prices of all of his creations upwards, particularly when he’s releasing three per month?

A bull case I see for rektguy is that it becomes the de facto profile pictute for members of the digital art community who feel estranged by the typical profile picture crowd made up of Apes, Doodles, Azukis, etc. A rektguy finally gives them the opportunity to rep a profile picture that aligns with the digital art community, and is a clear distinction fromi the vibes of the aforementioned projects.

Alas, I don’t have a crystal ball, so I can’t tell you for sure what’s in rektguy’s future. If OSF continues to build momentum in the digital art scene and NFT community at large, this would no doubt bring the floor of rektguy higher. In practice, this would look like new all-time highs for his 1/1 pieces along with increased engagement from the NFT community on his social media prescense.

As stated earlier, I do own a rektguy. In full transparency, I wouldn’t be surprised if rektguy cooled off and never returned to the all-time highs it has set in the last 48 hours, but I also wouldn’t be shocked if this project continued to grow and light the NFT world on fire.

I think the more people who learn about OSF and look at his art, the higher the demand for rektguy will be. It’s my goal that pieces like this help break down the barrier to entry of knowledge in a project like rektguy, where a considerable amount of contextual information is needed to understand what is really going on here.

It’s been a long piece today, so I thank you for sticking with me to the end.

If you’re new here and would like loads more of this content, you should subscribe to get it right into your inbox. I’ll be doing this all summer with so many different projects. When deciding between a free or paid subscription, remember that free subscribers only get half as much content as those who are paying. Use the button below to subscribe:

If you’re a returning subscriber and enjoyed the email today, or learned something new, I encourage you to share the newsletter through the button below to somebody you think it may be of interest to.

I recognize that oftentimes I get things wrong, or have people that disagree with my opinions. I love when I have conversations with these people because they’re the ones I learn the most from. Did I make a mistake or get something wrong? Let me know on Twitter:

That’s all I got today everybody. I’ll see paying subscribers for the email tomorrow and free subscribers in two days.

And down the Rabbit Hole we continue.

Mr. Fox.